Grown Rogue Reports Third Quarter 2025 Results

Pro Forma Revenue and Pro Forma Adjusted EBITDA, including New Jersey affiliate, ABCO Garden State LLC (“ABCO”), were $8.5 million and $1.7 million, respectively, up 26% and 25% year-over-year, and up 35% and 78% on an apples-to-apples basis*, excluding the 2024 third quarter contributions from the terminated Vireo services agreement.

Results reflect continued operational improvements and sales penetration in New Jersey, and better quarter-over-quarter operational performance and pricing improvement in Michigan, being partially offset by our growth investments in corporate overhead and pricing pressure in Oregon.

Expanded our balance sheet, borrowing an additional $5 million on our bank loan, bringing the total loan to $12 million with a blended interest rate of below 8%. The loan, along with anticipated operating cash flow, funds our near-term growth priorities, most notably Minnesota, and supports the development of our broader growth initiatives.

Reported IFRS revenue was $5.4 million, with Adjusted EBITDA of $0.1 million.

*Apples-to-apples Pro Forma Revenue and Pro Forma Adjusted EBITDA exclude $0.5 million of revenue and $0.4 million of Adjusted EBITDA contributions stemming from the Company’s former services agreement with Vireo in Q3 2024. This adjustment ensures a consistent and comparable financial performance analysis by isolating recurring operational results.

MEDFORD, Oregon, November 11, 2025 – Grown Rogue International Inc. (“Grown Rogue” or the “Company”) (CSE: GRIN | OTC: GRUSF), a flower-forward cannabis company combining craft values with disciplined execution, is pleased to report its third quarter 2025 financial results for the three months ended September 30, 2025.

All financial information is provided in U.S. dollars unless otherwise indicated.

Summary and Pro Forma Metrics (Q3 2025 vs. Q3 2024)

(US $ in millions) – Pro Forma figures are non-IFRS measures.

* Includes revenue from New Jersey (ABCO) which is not included in Grown Rogue Consolidated results

¹ Non-IFRS financial measure. See MD&A for further details and reconciliations

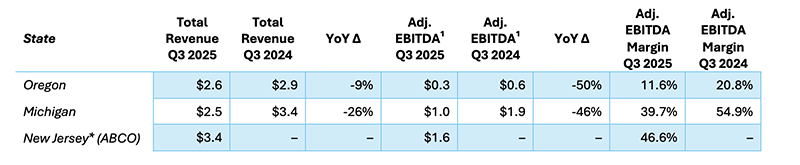

Market Performance by State (Q3 2025 vs. Q3 2024)

(US $ in millions)

¹ Non-IFRS financial measure. See MD&A for further details and reconciliations

*New Jersey operations launched late 2024; no year-over-year comparison available

Market Core KPIs (Q3 2025 vs. Q3 2024)

*New Jersey operations launched late 2024; no year-over-year comparison available

New Jersey affiliate, ABCO, demonstrated solid sequential growth by generating $3.4 million in revenue and $1.6 million in Adjusted EBITDA (46.6% margin) versus $2.7 million and $1.3 million, respectively in the previous quarter (48.6% margin). Roughly 80% of ABCO’s revenue was in branded, packaged flower and pre-rolls, with the balance being bulk flower sales. Operating KPIs were impacted by one fewer harvest in the quarter, leading to fewer pounds produced and higher costs per pound, despite modest yield improvement.

Michigan operations contributed $2.5 million in revenue and $1.0 million in Adjusted EBITDA (39.7% margin), with the majority of the sequential improvement in sales (+$0.26 million) flowing through to Adjusted EBITDA (+$0.23 million). ASPs on A-grade flower were up 6% sequentially but down 10% year-over-year. In addition to lower pricing, year-over-year revenue performance was impacted by a large sale of bulk trim in the prior-year quarter and a small inventory build in A-grade flower in the current quarter, resulting in a higher mix of lower-priced bulk B flower sales.

Oregon operations generated $2.6 million in revenue and $0.3 million in Adjusted EBITDA (11.6% margin), in a challenging quarter. Lower revenue and profitability were driven by continued pricing pressure (ASPs on A-grade flower down 28% year-over-year and 6% sequentially), as well as a large bulk sale of aged inventory. Management continues to view Oregon as a structurally competitive market, navigating another cyclical supply / demand environment driving down pricing and contributing to the year-over-year revenue decline.

CEO Commentary – Obie Strickler

“Coming out of our annual leadership summit in Medford, I’m more excited than ever about where Grown Rogue is headed. We have augmented our seasoned core team with experienced talent that is elevating our platform. Our disciplined, flower-forward, low-cost model positions us to win as regulated cannabis continues to evolve.

In New Jersey, our Grown Rogue and Yeti brands are gaining traction in a predominantly packaged-product market, and the work we’re doing on branding and packaging should strengthen our Michigan and Oregon businesses as we shift more volume into branded products. We are focused on disciplined, returns-driven growth, including thoughtful product extensions and compelling projects like Minnesota and the next phase of our New Jersey expansion, while actively evaluating distressed opportunities.”

Additional Commentary from CEO Obie Strickler

Flower-forward Product Extensions

In Oregon and Michigan, Grown Rogue continues to expand its flower-forward product portfolio by leveraging its cultivation capabilities, existing product strengths, and statewide sales and distribution. Over the last 18 months, the Company has become a top-five pre-roll producer in Oregon across the Grown Rogue and Yeti brands and has successfully introduced infused pre-rolls with strong demand.

The Company is launching its first cured resin vape cartridge in Oregon and has redesigned its pre-packaged flower program in Michigan to emphasize strain-specific packaging. Product innovation is guided by internal “tastemakers,” ensuring offerings reflect products the team is proud to consume, while reinforcing and advancing the Company’s brand strategy. Management intends to continue selectively adding products in key markets, with the goal of replicating best practices across states for the benefit of consumers.

New Markets

Beyond organic product extensions, Grown Rogue’s growth strategy includes new facility builds, existing facility expansions, and select acquisitions of ‘fixer upper’ assets, often associated with financial or operational distress. The Company applies a disciplined, returns-driven framework to capital deployment and organizational bandwidth.

Grown Rogue is prioritizing a new-build opportunity in Minnesota, which management views as the most attractive new build project in its opportunity set. With the Company’s administrative support, its National Director of Cultivation has received pre-approval for a Minnesota cultivation license allowing up to 30,000 square feet of flowering canopy. The Company’s preferred real estate site has received a conditional use permit; design engineers have been engaged, and a lease with a collaborative real estate partner is being finalized.

Minnesota’s limited supply of craft-quality indoor flower aligns with Grown Rogue’s organic growth model. We learned a lot about Minnesota during our advisory relationship with Vireo Growth. The Company is targeting initial market entry by early 2027 and is actively working to accelerate that timeline. Importantly, we have pursued a larger real estate solution in Minnesota than our normal pursuits, allowing us the flexibility to expand into the maximum allowed canopy should the market’s development support this larger scale. To support moving quickly and prudently, our initial plans call for approximately 10,000 square feet of bench flower canopy.

In light of this prioritization, and alongside several overlapping distressed opportunities under evaluation, Grown Rogue has moderated the pace of its Illinois new build, which it continues to view as an attractive future opportunity. The existing balance sheet and internally generated cash flow are expected to provide sufficient capital to fund the first phase of the Minnesota project, as well as complete the second phase of the New Jersey expansion.

Packaged Product & Brand Development

Grown Rogue’s legacy in Oregon continues to provide the operational foundation for the business. That experience, combined with our recent progress in New Jersey and a growing pipeline of opportunities, is driving the Company to build more aggressively for the future. In addition to a more favorable pricing environment in New Jersey relative to Oregon and Michigan, expansion into this market and the landscape of markets ahead of us, has accelerated investment in the Grown Rogue and Yeti brands.

In New Jersey, approximately 80% of sales are packaged products, effectively the reverse of the sales mix in Michigan and Oregon, two markets that have historically leaned much more into bulk vs branded wholesale. The Company expects ongoing upgrades to branding and packaging in New Jersey to support its Michigan and Oregon operations as it broadens product offerings and transitions a greater portion of its business mix toward branded products.

Third quarter results highlight both the opportunities and the structural challenges within the industry. Competing in mature markets with excess supply requires greater efficiency while preserving high-quality standards. Grown Rogue’s capabilities have been refined as a bulk wholesale producer, particularly in Oregon, where historically very little packaged flower for any brands is available at retail. This commercial discipline and sales-driven approach formed the basis of our expansion into Michigan.

The Company remains confident in its product quality and approach to genetics, reinforced by strong adoption of its products and third-party recognition, including recent second-place finishes in the indoor flower sativa and non-infused pre-roll categories at the New Jersey ‘Best-in-Grass’ awards. Management believes its low-cost foundation, coupled with a relentless focus on genetics and craft-quality flower, provides the building blocks for durable brand equity.

Management Commentary from Chief Strategy Officer, Josh Rosen

“Since joining Grown Rogue full time in February, I’ve only grown more excited about what we can accomplish with our capabilities and our disciplined, yet aggressive, approach to growth. My internal mandates were to help the team prepare for the next chapters of growth and to leverage my network to translate our consistent quality into a more brand-forward approach. I’m pleased with the progress we’re making on both fronts.

In our last earnings release, I highlighted a confluence of factors creating a window of opportunity to evaluate distressed assets, and we remain highly active — this is my core external mandate. Our work includes submitting multiple non-binding LOIs and ongoing follow-ups with bankers, receivers, and restructuring officers as they work through their processes. It has become abundantly clear that there are not many companies positioned like ours; most other potential buyers of distressed assets are heavily focused on retail or a much narrower set of states.

While we are unable to commit to specific timelines or size, we would be disappointed if these opportunities are not a meaningful contributor to our growth within the next several quarters.”

Management Commentary from CFO, Andrew Marchington

“As a reminder, and consistent with prior quarters, our New Jersey operations are conducted through an affiliate and are not consolidated into these IFRS financial statements. We expect to consolidate these results in our full-year 2025 financial statements, which will be prepared under U.S. GAAP.

For the three-month period ended September 30, 2025, ABCO generated unaudited cash flow from operations of $1.2 million. This amount is not included in Grown Rogue’s cash flows from operating activities in these IFRS financial statements. Currently, only cash repaid to Grown Rogue for its monthly operational support is reflected in cash flows from operations, while payments of interest and principal on ABCO’s notes payable to Grown Rogue are presented within investing activities. Once consolidated under U.S. GAAP, these underlying cash flows will be reflected within cash flows from operations.

To provide investors with a clearer view of our overall economic interest, we present Pro Forma Revenue and Pro Forma Adjusted EBITDA as supplemental non-IFRS measures illustrating the impact of the New Jersey operations on an as-consolidated basis. The reconciliations to reported IFRS results are included below.

Due to our affiliate structure in New Jersey, our IFRS results do not fully reflect the economic contribution of that market, which may affect how certain metrics, including cash flow, are interpreted. Inclusive of our New Jersey economic interest, we believe the business is demonstrating positive operating cash flow characteristics, and we are making capital allocation decisions with a continued focus on maintaining a strong liquidity position.”

Reconciliation of Reported to Pro Forma Results

(US$ in millions)

1Pro Forma revenue and Pro Forma Adjusted EBITDA are non-IFRS financial measures that include the results of the Company’s New Jersey affiliate, ABCO Garden State LLC (“ABCO”), which are not consolidated in the Company’s IFRS financial statements. Management believes these measures provide investors with additional insight into the Company’s economic interest in all operating assets. Further details and reconciliations for non-IFRS financial measures are provided in the Company’s MD&A for the three and nine months ended September 30, 2025, which will be filed today on SEDAR+ (www.sedarplus.ca) and EDGAR (www.sec.gov).

Conference Call and Webcast Information

Grown Rogue will release its financial statements and Management’s Discussion and Analysis for the three- and nine-month periods ended September 30, 2025, after market close on Tuesday, November 11, 2025.

To further enhance investor disclosure, the Company will also post an updated Company Overview presentation to its website and host a conference call and webcast shortly after the release.

Conference Call Details

Date: Tuesday November 11, 2025

Time: 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time)

Webcast: Register

Dial-in: 1-800-836-8184 (Toll-Free in North America)

A telephone replay of the conference call will be available until November 18, 2025, by dialing (+1) 888 660 6345 and using replay code: 88691#

The webcast will be archived on Grown Rogue’s Investor Relations website for approximately 90 days following the call. For assistance, please contact: invest@grownrogue.com

About Grown Rogue

Grown Rogue International Inc. (CSE: GRIN | OTC: GRUSF) is a flower-forward cannabis company rooted in Oregon’s Rogue Valley, a region known for its deep cannabis heritage and commitment to quality. With operations in Oregon, Michigan, and New Jersey—and expansion underway in Illinois— Grown Rogue specializes in producing designer-quality indoor flower. Known for exceptional consistency and care in cultivation, our products are valued by retailers, budtenders, and consumers alike. By blending craft values with disciplined execution, we’ve built a scalable, capital-efficient platform designed to thrive in competitive markets. We believe sustained excellence in cannabis flower production is the engine of the industry’s supply chain—and our competitive advantage. For more information about Grown Rogue, please visit www.grownrogue.com.