Grown Rogue Reports Second Quarter 2025 Results

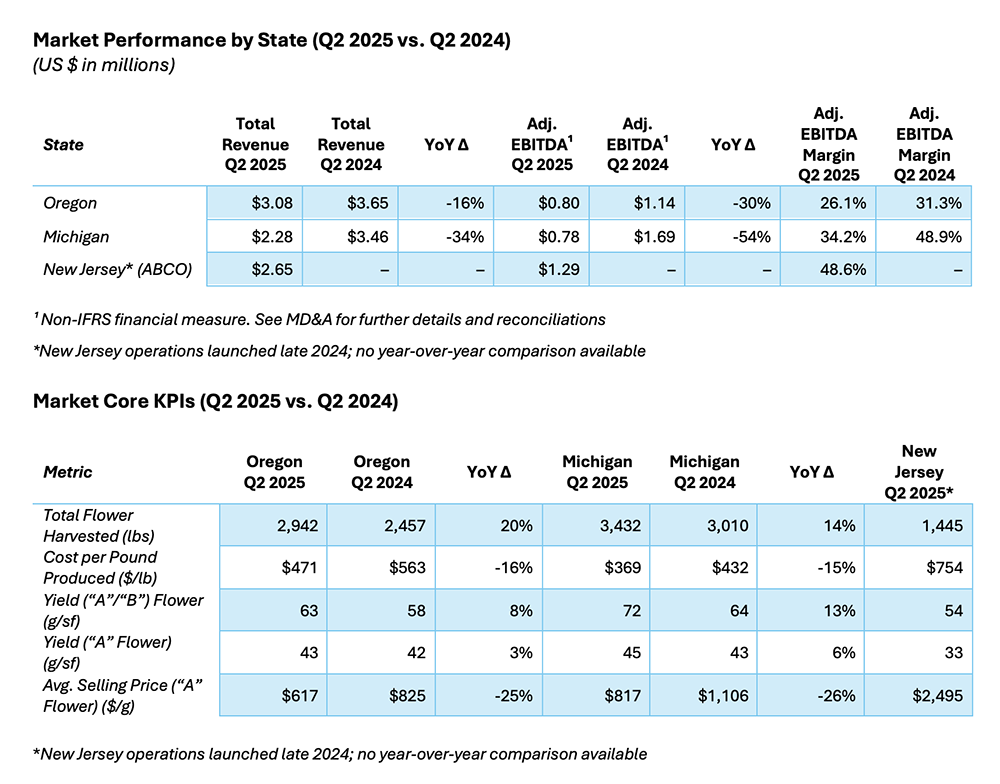

Pro Forma Revenue and Pro Forma Adjusted EBITDA, including New Jersey affiliate, ABCO Garden State LLC (“ABCO”), were $8.01 million and $1.82 million, respectively, up 4% and down 12% year-over-year, and up 8% and down 2% on an apples-to-apples basis, excluding the 2024 second quarter contributions from the termination of the Vireo services agreement.

Continued ramp in our New Jersey cultivation operations’ second full quarter of sales, ongoing growth investments in talent and overhead, and substantial pricing pressure in Oregon and Michigan impacted our state-level and overall margins.

Oregon operations generated $3.08 million in revenue and $0.80 million in Adjusted EBITDA (26.1% margin), maintaining healthy margins despite a challenging pricing environment, with our ASPs on A-grade flower down 25% YoY.

Michigan operations contributed $2.28 million in revenue and $0.78 million in Adjusted EBITDA (34.2% margin), maintaining healthy margins despite a challenging pricing environment, with our ASPs on A-grade flower down 26% YoY.

New Jersey affiliate ABCO generated $2.65 million in revenue and $1.29 million in Adjusted EBITDA (48.6% margin), demonstrating continued operational progress and replicable execution of our cultivation platform.

Reported IFRS revenue was $5.56 million, with Adjusted EBITDA of $0.53 million.

MEDFORD, Oregon, August 12, 2025 – Grown Rogue International Inc. (“Grown Rogue” or the “Company”) (CSE: GRIN | OTC: GRUSF), a flower-forward cannabis company, combining craft values with scaled production and disciplined execution, is pleased to report its second quarter 2025 financial results for the three months ended June 30, 2025.

All financial information is provided in U.S. dollars unless otherwise indicated.

Management Commentary from CEO, Obie Strickler

“We have seen pricing in Oregon and Michigan compress significantly over the last year. We want to be clear to investors about our perspective on this: we believe price normalization is a natural and healthy part of any market — especially in cannabis, where lower prices pull more consumers into safer regulated products. We also firmly believe Oregon and Michigan are not outliers but rather harbingers of what every market in the nation will eventually experience to similar degrees, albeit on different timelines. Even as pricing has come down, our teams continue to deliver profitability and attractive returns on capital.

We recognize that pricing will be cyclical and that we do not control the overall market price. Instead, we focus on what we can control — executing at the highest levels possible to continue to elevate our craft. This means remaining a constantly improving team, particularly when it comes to driving cost efficiencies and enhancing flower quality. From my lens, our team has executed on these priorities exceptionally well. We are applying everything we have learned in Oregon and Michigan in New Jersey, and we are excited to continue to apply these learnings to the other growth engines in our business.

We are underway with construction of Phase 1 of our affiliate Illinois cultivation facility, and we are evaluating Minnesota as our next potential organic, new build market. With our administrative support, our National Director of Cultivation was awarded pre-approval for a Minnesota cultivation license, and we are currently evaluating real estate options. Minnesota has the key attributes that align with our organic growth model, most notably, a limited supply of craft-quality indoor flower. We’re excited about the potential to bring Grown Rogue’s flower-forward approach to customers in a state we came to know well during our advisory agreement with Vireo.

While expanding into new markets, we’ve also made intentional investments in corporate overhead and team capabilities. We’re bringing in the right talent and systems to ensure that as we grow, we preserve the operational discipline and culture that set Grown Rogue apart. These investments may put short-term pressure on margins, but they position us to capitalize on the opportunities we see emerging across the industry — including several distressed opportunities currently under evaluation.

We are also monitoring recent federal discussions on potential rescheduling. We support measures that advance legalization, decriminalization, and reduce regulatory complexity. From a business standpoint, we’d welcome any changes that ease the regulatory burden of operating in the cannabis industry, although we do not expect any of the potential near-term decisions being discussed to materially impact our operations or growth strategy.”

Management Commentary from CSO, Josh Rosen

“A confluence of factors, most notably increased competition, limited access to incremental capital and substantial debt and lease burdens, has created a window of significant financial and operational distress across the industry, with overbuilt and expensive cultivation infrastructure often at the center. We view this period of industry distress as a real opportunity — our flower-forward model is built to thrive in competitive, price-sensitive markets. By staying low-cost, high-quality, and disciplined, we’re positioned to capture share where others are struggling, and we plan to lean into these opportunities.

One of the reasons I joined the Grown Rogue team was my personal experience navigating complex and immature state-level supply chains and recognizing that the efficient production of quality flower is the economic engine of the industry — amplifying profits across the supply chain during periods of high pricing and providing resilience when markets grow more competitive. Distressed and restructuring transactions tend to be slow and complex, so it’s hard to predict exact timing or the scale of what we might accomplish — but we’ll be disappointed if this isn’t a meaningful contributor to our growth over the next 18–24 months.

Looking ahead, we remain laser-focused on executing our core organic growth strategy — expanding in New Jersey, advancing in Illinois, and positioning ourselves to enter Minnesota if the opportunity aligns. At the same time, we’re prepared to leverage our operational expertise into distressed opportunities. I’m confident in the strong foundation we’re building to support our future growth.”

Management Commentary from CFO, Andrew Marchington

“Financially, we remain in a strong and flexible position – our core operations in Oregon and Michigan continue to generate healthy cash flow, and New Jersey is already contributing meaningfully while still early in its scale-up.

As a reminder, because our New Jersey operations are through an affiliate, their results aren’t consolidated in our IFRS financials. Instead, we provide Pro Forma Revenue and Adjusted EBITDA as supplemental measures – to give investors a better view of our total economic interest. We’ve included a reconciliation to reported IFRS results below for clarity.”

Pro Forma revenue and Pro Forma Adjusted EBITDA are non-IFRS financial measures that include the results of the Company’s New Jersey affiliate, ABCO Garden State LLC (“ABCO”), which are not consolidated in the Company’s IFRS financial statements. Management believes these measures provide investors with additional insight into the Company’s economic interest in all operating assets. Further details and reconciliations for non-IFRS financial measures are provided in the Company’s MD&A for the three and six months ended June 30, 2025, which will be filed today on SEDAR+ (www.sedarplus.ca) and EDGAR (www.sec.gov).

Conference Call and Webcast Information

Grown Rogue will release its financial statements and Management’s Discussion and Analysis for the three- and six-month periods ended June 30, 2025, after market close on Tuesday, August 12, 2025.

To further enhance investor disclosure, the Company will also post an updated Company Overview presentation to its website and host a conference call and webcast shortly after the release.

Conference Call Details

Date: Tuesday August 12, 2025

Time: 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time)

Webcast: Register

Dial-in: 1-800-836-8184 (Toll-Free in North America)

A telephone replay of the conference call will be available until 19 August 2025, by dialing (+1) 888 660 6345 and using replay code: 33641#

The webcast will be archived on Grown Rogue’s Investor Relations website for approximately 90 days following the call. For assistance, please contact: invest@grownrogue.com

About Grown Rogue

Grown Rogue International Inc. (CSE: GRIN | OTC: GRUSF) is a flower-forward cannabis company rooted in Oregon’s Rogue Valley, a region known for its deep cannabis heritage and commitment to quality. With operations in Oregon, Michigan, and New Jersey—and expansion underway in Illinois— Grown Rogue specializes in producing designer-quality indoor flower. Known for exceptional consistency and care in cultivation, our products are valued by retailers, budtenders, and consumers alike. By blending craft values with disciplined execution, we’ve built a scalable, capital-efficient platform designed to thrive in competitive markets. We believe sustained excellence in cannabis flower production is the engine of the industry’s supply chain—and our competitive advantage.

For more information about Grown Rogue, please visit www.grownrogue.com.