Grown Rogue Reports Second Quarter 2023 Results, Record Operating Cash Flow and Free Cash Flow

Revenue of $6.0M compared to $4.7M in Q2 2022, an increase of 28%

Operating Cash Flow (OCF), before changes in working capital (BC WC), of $1.7M compared to $1.1M in Q2 2022, an increase of 62%

Free Cash Flow1 (FCF) of $1.0M, after $0.7M in investments in WC and capital expenditures

Ended quarter with $3.8M of cash on hand

Subsequent to quarter-end, announced a strategic advisory agreement with Goodness Growth Holdings (OTC: GDNSF, CSE:GDNS) to focus on improving quality and efficiencies in Goodness' Minnesota and Maryland operations

MEDFORD, Ore., June 20, 2023 /CNW/ - Grown Rogue International Inc. ("Grown Rogue" or the "Company") (CSE: GRIN) (OTC: GRUSF), a craft cannabis company operating in Oregon and Michigan, is pleased to report its fiscal second quarter 2023 results for the three months ended April 30, 2023. All financial information is provided in U.S. dollars unless otherwise indicated.

Second Quarter 2023 Financial Summary ($USD Millions)

Management Commentary

"This was another exciting quarter with record operating cash flow and free cash flow as we continue to see the tremendous execution exhibited by our team", said Obie Strickler, CEO of Grown Rogue. "Our $6M+ of revenue was a new company record by more than 18%, highlighting our continued focus on producing high quality cannabis that delights our team and customers. We continue to generate substantial free cash flow margins and are focused on using that capital to bring our products to new markets and expand our consumer base. We are really excited about our recently announced agreement with Goodness Growth to expand our cultivation expertise into additional markets and are encouraged by the positive feedback we are seeing and hearing from those markets. In Q2, we recorded over $270k in revenue from this agreement, which was more than anticipated as the agreement was not definitive until after the quarter ended. I'm pleased with the success we are seeing so far in Q3 and anticipate strong growth both in Minnesota and from the launch of adult use sales in Maryland on July 1st," continued Mr. Strickler. Our relentless focus on genetics continues to reap benefits in both Oregon and Michigan as we take pride in being tastemakers in the industry. We are proud to be launching new proprietary genetics combined with strain specific packaging in Michigan as well as craft pre-rolls in Oregon in the coming weeks. We believe that our philosophy and practice of constant iteration and improvement will engender more customer trust and deepen the relationship we have with our existing fans," Mr. Strickler continued.

"Regarding capital allocation, we continue to focus on producing free cash flow to best position ourselves to meet our balance sheet obligations while being prepared for new market opportunities, using only a modest amount on increased working capital. With our internal cash generation and our cash position at the highest ever reported, we feel confident in our ability to take advantage of high-quality opportunities as they arise.

I want to thank the entire Grown Rogue team for their continued efforts and look forward to updating shareholders on our new market efforts in due course."

Oregon Market Highlights ($USD Millions)

#1 Flower brand for eight consecutive quarters, according to LeafLink's MarketScape data

Focusing on increasing market share by launching craft pre-roll products in Q3 2023

Total Oregon state indoor wet weight harvested decreased 8% year-over-year, according to the Oregon Liquor and Cannabis Commission while Grown Rogue indoor wet weight harvested increased by 15% year over year

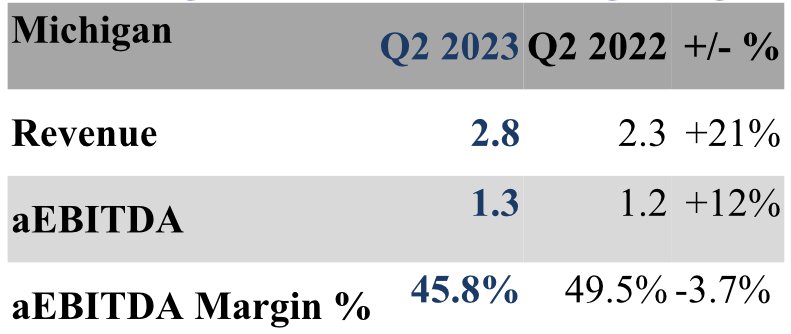

Michigan Market Highlights ($USD Millions)

Pricing per ounce of flower has increased for four straight months, according to the Michigan Cannabis Regulatory Agency

Launching strain specific packaging in Q3 2023, and anticipate increases in both pricing and product mix of our pre-packaged products

Michigan operations are through Golden Harvests, LLC.

NOTES:

1. The Company's "Free cash flow" metric is defined by cash flow from operations minus capital expenditures.

2. The Company's "aEBITDA," or "Adjusted EBITDA," is a non-IFRS measure used by management that does not have any prescribed meaning by IFRS and that may not be comparable to similar measures presented by other companies. The Company defines "EBITDA" as the Company's net income or loss for a period, as reported, before interest, taxes, depreciation and amortization, and is further adjusted to remove transaction costs, stock-based compensation expense, accretion expense, gain (loss) on derecognition of derivative liabilities, the effects of fair-value accounting for biological assets and inventory, as well as other non-cash items and items not representative of operational performance as reported in net income (loss). Adjusted EBITDA is defined as EBITDA adjusted for the impact of various significant or unusual transactions. The Company believes that this is a useful metric to evaluate its operating performance.

NON-IFRS FINANCIAL MEASURES

EBITDA and aEBITDA are non-IFRS measures and do not have standardized definitions under IFRS. The Company has provided the non-IFRS financial measures, which are not calculated or presented in accordance with IFRS, as supplemental information and in addition to the financial measures that are calculated and presented in accordance with IFRS. These supplemental non-IFRS financial measures are presented because management has evaluated the financial results both including and excluding the adjusted items and believe that the supplemental non-IFRS financial measures presented provide additional perspective and insights when analyzing the core operating performance of the business. These supplemental non-IFRS financial measures should not be considered superior to, as a substitute for or as an alternative to, and should only be considered in conjunction with, the IFRS financial measures presented herein. Accordingly, the following information provides reconciliations of the supplemental non-IFRS financial measures, presented herein to the most directly comparable financial measures calculated and presented in accordance with IFRS.

About Grown Rogue

Grown Rogue International (CSE: GRIN | OTC: GRUSF) is a craft cannabis company focused on delighting customers with premium flower and flower-derived products at fair prices. Our roots are in Southern Oregon where we have demonstrated our capabilities in the highly competitive and discerning Oregon market and, more recently, we successfully expanded our platform to Michigan. We combine our passion for product and value with a disciplined approach to growth, prioritizing profitability and return on capital. Our strategy is to pursue capital efficient methods to expand into new markets, bringing our craft quality and value to more consumers. We also continue to make modest investments to improve our outdoor craft cultivation capabilities in preparation for eventual interstate commerce.

FORWARD-LOOKING STATEMENTS

This press release contains statements which constitute "forward–looking information" within the meaning of applicable securities laws, including statements regarding the plans, intentions, beliefs and current expectations of the Company with respect to future business activities. Forward– looking information is often identified by the words "may," "would," "could," "should," "will," "intend," "plan," "anticipate," "believe," "estimate," "expect" or similar expressions and include information regarding: (i) statements regarding the future direction of the Company (ii) the ability of the Company to successfully achieve its business and financial objectives, (iii) plans for expansion of the Company and securing applicable regulatory approvals, and (iv) expectations for other economic, business, and/or competitive factors. Investors are cautioned that forward–looking information is not based on historical facts but instead reflect the Company's management's expectations, estimates or projections concerning the business of the Company's future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although the Company believes that the expectations reflected in such forward–looking information are reasonable, such information involves risks and uncertainties, and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements of the combined company. Among the key factors that could cause actual results to differ materially from those projected in the forward–looking information are the following: changes in general economic, business and political conditions, including changes in the financial markets; and in particular in the ability of the Company to raise debt and equity capital in the amounts and at the costs that it expects; adverse changes in the public perception of cannabis; decreases in the prevailing prices for cannabis and cannabis products in the markets that the Company operates in; adverse changes in applicable laws; or adverse changes in the application or enforcement of current laws; compliance with extensive government regulation and related costs, and other risks described in the Company's public disclosure documents filed on Sedar.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward–looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward–looking information except as otherwise required by applicable law.

The Company is indirectly involved in the manufacture, possession, use, sale and distribution of cannabis in the recreational cannabis marketplace in the United States through its indirect operating subsidiaries. Local state laws where its subsidiaries operate permit such activities however, these activities are currently illegal under United States federal law. Additional information regarding this and other risks and uncertainties relating to the Company's business are disclosed in the Company's Listing Statement filed on its issuer profile on SEDAR at www.sedar.com. Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

SOURCE Grown Rogue International Inc.

For further information: on Grown Rogue International please visit www.grownrogue.com or contact: Obie Strickler, Chief Executive Officer, Obie@grownrogue.com; Jakob Iotte, Director of Business Development and IR, Jakeiotte@grownrogue.com, (458) 226-2100